[2025] RedFlag Research: $OST Another China Hustle in Play? Plus, Our Next “Watch Closely” Pick

OST stock collapses after a classic China-based small-cap play. RedFlag Research called it early—here’s what happened and why our next pick stock might be next in line for a major dump.

RedFlag Research Warned About OST – Another China Stock Trap?

At RedFlag Research, we’ve seen this movie before. A low-float, China-based microcap company suddenly pops, raises cash, and then collapses—leaving retail traders bag-holding.

That’s exactly what happened with OST stock (Ostin Technology Group), and yes, we flagged it before the crash.

Let’s walk through the OST collapse, what it tells us about the broader trend of China-based pump-and-dump stocks, and why our next stock pick might be the next red flag waving.

OST Stock News: What Went Wrong?

Key Facts About OST (Ostin Technology Group)

Founded: 2010 in China

Sector: Display modules and polarizers

Reverse Split: 1-for-10 in December 2024

Capital Raise: $5M via direct offering in April 2025 at $0.55/share

Denial Statement: Released June 27, 2025, denying material issues

What Actually Happened?

OST stock tanked really hard . There was no bounce, no real news, and no investor communication.

This looks eerily similar to other Chinese reverse-merger stocks that:

Use Nasdaq listing for credibility

Execute reverse splits to maintain compliance

Raise capital cheaply, often with warrants

Go silent while shares implode

$OST appears to be a Chinese reverse-merger-like listing that has destroyed over 95% of shareholder value in mere weeks, following a reverse split and dilutive capital raise. The stock may be a textbook pump-and-dump or capital recycling machine designed to enrich insiders and toxic financiers at the expense of retail traders. Nasdaq compliance efforts appear performative. With minimal revenue, large debt, and questionable governance, we believe OST is a terminal zero.

Recent Events & Market Sentiment

On June 27, issued a statement denying undisclosed material issues as share price plummeted

In April, raised $5M via a registered direct offering at $0.55 per share, bundled with warrants

Granted multiple extensions by Nasdaq to regain compliance

Typical Pattern of China-Based Small-Cap Pump and Dumps

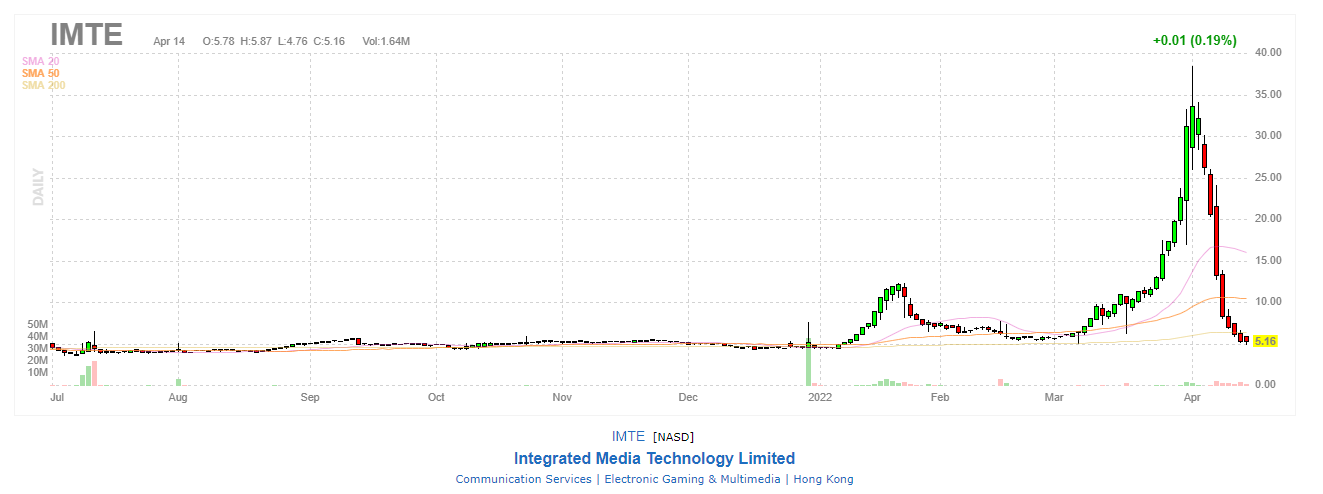

Here’s the repeatable pattern we’ve seen in stocks like OST, DOGZ, ILAG, and JCSE:

Remember $DOGZ & $KIDZ in our previous post? Check out if you want more detail;

there is ILAG, JCSE, you name it..